what is tax planning explain its characteristics and importance

Tax planning is a focal part of financial planning. However this is not its sole objective.

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Every prudence person to.

. ERP systems typically include the following. Many people use the term tax planning but it is often misunderstood. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and.

Planning starts with the determination of objectives. It represents a payment out of the income. The aim of this activity is to minimise the amount of taxes you pay on your personal.

A tax is a leakage from the circular flow of income into the public sector. Tax planning is crucial for budgetary. Tax planning is the logical analysis of a financial position from a tax perspective.

Free shipping on qualified orders. Tax Planning is resorted to maximize the cash inflow and minimize the cash outflow. Tax planning is the logical analysis of a financial position from a tax perspective.

Tax planning means you and your tax planning advisor take an in-depth look at where you are most liable for taxes. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. Tax planning is a way to find out how much money you are paying on tax and also a way to help minimise the tax liability the amount owed to tax authorities through the use of.

Tax planning is a process of analysing and evaluating an individuals financial profile. It ensures savings on taxes while simultaneously conforming to the legal obligations and requirements of the Income Tax Act. Tax planning is an integral activity conducted by every person earning through salary professional or other activities and organizations in India.

It is the art of learning how to manage your affairs in ways that postpone. Objectives of Tax Planning Tax planning in fact is an honest and rightful approach to the attainment of. In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances exclusions exemptions.

We cannot think of planning in absence of objective. Free easy returns on millions of items. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances.

Tax planning refers to the process of minimising tax liabilities. Tax planning lets you decide how to approach each. The Importance of Tax Planning.

Importance Of Tax Planning For Corporates And Individuals We would like to show you a description here but the site wont allow us. Planning contributes to Objectives. Discuss the objectives importance and types of tax planning.

It is paid by individuals corporations and other associations of individuals. The following noticeable importance is found. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as.

Since Tax is kind of cast the reduction of cost shall increase the profitability. Tax planning refers to financial planning for tax efficiency.

A Summary And Comparison Of Management Relevant Characteristics Of Download Scientific Diagram

A Summary And Comparison Of Management Relevant Characteristics Of Download Scientific Diagram

8 Essential Characteristics Of Tax

Stepbystep Finance Budget Money Free Freedom Tips Tiptuesday Amazing Read Ideas Learn Basic Investing Infographic Investing Finance Investing

Brand Development Services Brand Architecture Brand Promotion Value Proposition Custome Brand Architecture Marketing Strategy Business Brand Management

Income Tax Multiple Choice Questions Mcq With Answers Updated Income Tax Income Tax Day

10 Characteristics Of A Good Erp System Accounting Education

Tax Planning Definition Goals Importance Advantages Types And More

Desirable Characteristics Of Agroforestry Systems For Biodiversity Download Table

/What-factors-influence-microeconomic_round2-b5aa0bb64b7045819fc19c99649d7482.png)

What Factors Influence Competition In Microeconomics

Dividend Per Share Dps Accounting And Finance Finance Investing Learn Accounting

15 Advantages Of Computerized Accounting System Computerized Accounting Accounting Accounting And Finance

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Educational Psychology Interactive Values Educational Psychology Kohlberg Moral Development Psychology

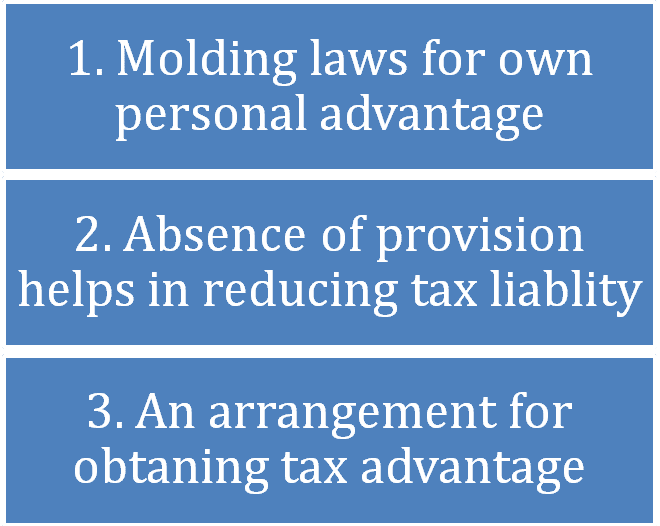

The Concept Of Tax Evasion And Tax Avoidance Definition And Differences

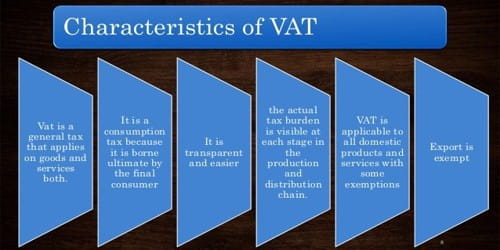

Characteristics Of Value Added Tax Vat Assignment Point

Definition Of Leadership What Is Leadership Leadership Lesson